News

Vote for The Tiny Foxes. Help them secure a $5,000 People’s Choice Award

We’re excited to share that Tiny Foxes has been shortlisted for a $5,000 People’s Choice grant and we believe with your vote we can all make a difference

Super on Payday: Fundamental Changes for Employers

If you run a business, you already know the juggling act that comes with managing the payroll process, paying staff on time, managing cash flow, and staying compliant. From 1 July 2026, there’s a major change coming that will reshape how you handle superannuation contributions for staff. It’s called Payday Super, and it became law on 4 November 2025.

Common Sense Prevails in Super Tax Revisions

Breaking news out of Canberra the Federal Treasurer has announced several significant amendments to the proposed tax on superannuation

balances over $3 million.

In what many are calling a common-sense adjustment, the government has confirmed:

Accessing superannuation funds for medical treatment or financial hardship

Superannuation is one of the largest assets for many Australians and offers significant tax advantages, however, strict rules apply to when it can be accessed. While super is most commonly accessed at retirement, death or disability, there are limited situations where earlier access may be possible.

ATO Interest Charges Are No Longer Deductible – What You Can Do

Leaving debts outstanding with the ATO is now more expensive for many taxpayers. General interest charge (GIC) and shortfall interest charge (SIC) imposed by the ATO is no longer tax-deductible from 1 July 2025. This applies regardless of whether the underlying tax debt relates to past or future income years.

ASIC has issued a warning about a surge in scam emails impersonating ASIC

ASIC has issued a warning about a surge in scam emails impersonating ASIC and targeting Registry customers. These fraudulent emails attempt to trick individuals and businesses into handing over personal information and paying fees.

Congratulations, Kurt – Our Newest Qualified Financial Adviser

We’re thrilled to celebrate Kurt Resch who has officially earned his credentials as a licensed financial adviser. Kurt’s achievement represents years of dedication, study, and hands-on experience—and we couldn’t be prouder to have him on the Forsyths team.

A win for those carrying student debt

In support of young Australians and in response to the rising cost of living, the Australian Government has passed legislation to reduce student loan debt by 20% and change the way that loan repayments are determined.

Superannuation guarantee: due dates and considerations for employees and employers

On 1 July 2025 the superannuation guarantee rate increased to 12% which is the final stage of a series of previously legislated increases.

Finalist in the Outstanding Employee category

At Forsyths, we’re passionate about recognising the incredible people who shape our culture and drive our success. This month, we’re thrilled to celebrate Diane (Di) McLeod who has been named a Finalist in the Outstanding Employee category at the Tamworth Business Chamber Quality Business Awards.

Disaster Recovery Assistance – What Support is Available?

With the recent weather events and flooding across the region, it’s important to keep updated with the recovery assistance and funding available through the NSW Rural Assistance Authority (RAA).

Interest deductions: risks and opportunities

This tax season, we’ve seen a surge in questions about whether interest on a loan can be claimed as a tax deduction. It’s a great question as the way interest expenses are treated can significantly affect your overall tax position. However, the rules aren’t always straightforward. Here’s what you need to know.

Luxury cars: the impact of the modified tax rules

With the purchasing of luxury vehicles on the rise it’s important to be aware of some specific features of the tax system that can impact on the real cost of purchase. Often the tax rules provide taxpayers with a worse tax outcome if the car will be used for business or other income producing purposes compared with a non-luxury car, but this depends on the situation.

Staying One Step Ahead: Cyber Security & Fraud Protection Seminar

In today’s fast-paced digital world, cybercrime and fraud are becoming some of the greatest threats to small and medium-sized

businesses and protecting your data, finances and reputation has never been more critical.

In July, Forsyths partnered with Cloudwize, Sophos and Westpac delivered an exclusive Cyber Security & Fraud Protection Seminar at our

Tamworth office.

Division 296 super tax and practical things to consider

Division 296 super tax is a controversial Federal Government proposal to impose an extra 15% tax on some superannuation earnings for individuals if their total superannuation balance (TSB) is over $3 million as at 30 June of the relevant income year.

Important tax update - deductions for ATO interest charges scrapped

If you're carrying an Australian Taxation Office (ATO) debt there is a good chance that it will cost you even more from 1 July 2025 onwards. This is because from 1 July 2025 two types of interest charges imposed by the ATO are no longer deductible.

Trust funds: are they still worth the effort?

For decades, trust structures have been a cornerstone of the Australian tax and financial system, prized for their asset protection and flexibility when it comes to income distributions. However, with regulatory changes and mounting administrative complexity the shine has been wearing off lately, prompting some businesses and investors to rethink their use.

Forsyths Foundation 2025 – Supporting Local Communities

We believe in making a difference where it matters most – in the communities where we live and work. Through the Forsyths Foundation, our team comes together each year to help fund and support organisations that change lives.

Celebrating Growth From Within

At Forsyths, we believe our people are our greatest strength. When one team member grows, we all succeed and we are proud to support every individual in realising their full potential. That’s why we’re delighted to share the latest career promotions across our business.

From Air Fryers to Swimwear - Tax Deductions to Avoid

With the 2025 tax season fast approaching the Australian Taxation Office (ATO) is reminding taxpayers to be careful when claiming work related expenses. This is in reaction to a spate of claims that didn’t quite pass the ‘pub test’.

ATO's New Requirements for NFPs

If you are involved with running a not for profit (NFP) organisation it is important to be aware of key obligations and requirements. In particular, if the NFP qualifies as a tax exempt entity there are some specific conditions that need to be satisfied and a relatively new ATO reporting obligation which needs to be undertaken to maintain that income tax exempt status.

Labor's Victory - Unpacking the Promises and Priorities

As the Labor party settle back into their seats having secured a majority in the House of Representatives, we look at the campaign promises and the unfinished business from the last term.

EOFY is fast approaching

Key changes are coming: the SG rate rises to 12% from 1 July 2025, and Payday Super starts in 2026. Businesses should prepare now to stay compliant and manage cash flow.

The ATO’s updated small business benchmarking tool

The ATO has updated its small business benchmarks with the latest data taken from the 2022–23 financial year. These benchmarks cover 100 industries and allow small businesses to compare their performance, including turnover and expenses, against others in their industry.

Property subdivision projects: the tax implications

As the urban sprawl continues in most major Australian cities, we are often asked to advise on the tax treatment of subdivision projects. Before jumping in and committing to anything, it is important to understand the tax liabilities that might arise from these projects.

Threshold for tax-free retirement super increases

The amount of money that can be transferred to a tax-free retirement account will increase to $2m on 1 July 2025.

Fringe Benefits Tax 2025: What you need to know

The Fringe Benefits Tax (FBT) year ends on 31 March. We’ve outlined the hot spots for employers and employees.

Forsyths Principals Retreat: Planning for Success

Each year, our Forsyths Principals come together for a dedicated four-day retreat—a valuable opportunity to strategise for the year ahead, analyse industry trends, and set new goals to support our business, our clients, and our people. This year, our team traveled to the stunning coastal region of Port Stephens for an inspiring and productive retreat.

Forsyths Gunnedah Proudly Sponsoring the 2025 Gunnedah Show.

Forsyths Gunnedah is once again a proud sponsor of the Grand Champion Prize in the Art Section at the 2025 Gunnedah Show held on Friday, April 4 to Sunday, April 6.

Forsyths Proudly Supporting Tamworth Downunder Cricket at U-PRO Club World Series in Dubai

At Forsyths, we believe in supporting the local communities where we live and work. That’s why we are proud to be Gold Sponsors of Tamworth Downunder Cricket, who will be representing Tamworth at the U-PRO Club World Series in Dubai from April 4 – April 13, 2025!

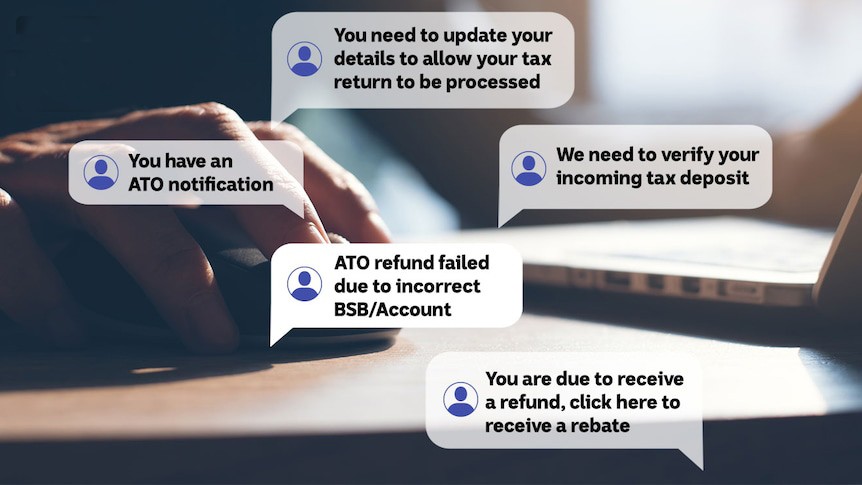

Scam Alert: Beware of Fake Company Payment Requests

A new scam has been circulating where fraudsters impersonate the Australian Securities and Investments Commission (ASIC), and other registration companies are asking individuals and businesses for payments to release funds or assets.

Introducing Forsyths Investment Portfolios

We are excited to introduce a new investment service for our clients - the Forsyths Multi-Asset and Income Portfolios.

Threshold for tax-free retirement super increases

The amount of money that can be transferred to a tax-free retirement account will increase to $2m on 1 July 2025.

Is there a problem paying your super when you die?

The Government has announced its intention to introduce mandatory standards for large superannuation funds to, amongst other things, deliver timely and compassionate handling of death benefits. Do we have a problem with paying out super when a member dies?

Will credit card surcharges be banned?

If credit card surcharges are banned in other countries, why not Australia? We look at the surcharge debate and the payment system complexity that has brought us to this point.

Why the ATO is targeting babyboomer wealth

The Australian Taxation Office (ATO) thinks that wealthy babyboomer Australians, particularly those with successful family-controlled businesses, are planning and structuring to dispose of assets in a way in which the tax outcomes might not be in accord with the ATO’s expectations.

Investing in the Future: Forsyths Sponsors Financial Literacy for Calrossy Students

At Forsyths, we believe that financial literacy is a cornerstone for future success, which is why we are proud to sponsor the Lifeskills Academy for Calrossy Year 10 students in 2025.

RBA Announces First Rate Cut Since 2020

For the first time since 2020, the Reserve Bank of Australia (RBA) has announced a rate cut, reducing the cash rate target to 4.10%. This decision signals confidence in the Australian economy’s stability but will have different implications depending on your financial situation.

Welcoming Steve Thomson to Forsyths

We are delighted to introduce Steve Thomson, who joined Forsyths in February as our new Director of Financial Services. With over 30 years of experience in the financial services industry, Steve brings a wealth of expertise, leadership, and strategic insight that will further strengthen our team and the services we provide to our clients.

Stay Alert: Counterfeit Cash Circulating in Local Businesses

While the saying "cash is king" still holds true for many businesses, recent incidents of counterfeit banknotes have been discovered in EBD (Electronic Bulk Deposit) bags by Armaguard highlight the risks of handling physical money.

Halfway Through the Taxation Year: The Power of Planning

As the calendar flips to the second half of the taxation year, many business owners find themselves caught in the whirlwind of day-to-day

operations. For some, this period feels like just another checkpoint; for others, it’s a wake-up call to take control of their financial

strategies.

This is the story of David, the owner of a growing manufacturing business. Like many entrepreneurs, David started the year with ambitious goals but soon got swept up in the demands of managing his team, fulfilling orders, and keeping customers happy. By the time he realised it, the year was already half over, and he hadn’t yet revisited his business plan.

Supporting the Next Generation: Forsyths and the Gunnedah Community Scholarship Fund

At Forsyths, we believe that investing in the next generation is key to building strong, vibrant communities. That’s why we are proud to support the Gunnedah Community Scholarship Fund, an initiative that has been making a tangible difference in the lives of young people for more than 20 years.

What’s ahead in 2025?

The last few years have been a rollercoaster ride of instability. 2025 holds hope, but not a guarantee, of greater stability and certainty. We explore some of the key changes and challenges.

Ricky Goel Shines Bright at the Rising Star Awards 2024

We are thrilled to share that Ricky Goel has won the Audit category at the 2024 Rising Star Awards in Sydney on Friday 22nd November.

Bah humbug: The Christmas tax dilemma

Don’t want to pay tax on Christmas? Here are our top tips to avoid giving the Australian Tax Office a bonus this festive season.

What makes or breaks Christmas?

The cost of living has eased over the past year but consumers are still under pressure. For business, planning is the key to

managing Christmas volatility.

The countdown to Christmas is on and we’re in the midst of a headlong rush to maximise any remaining opportunities before the Christmas

lull. Busy period or not, Christmas causes a period of dislocation and volatility for most businesses. The result is that it is not

‘business as usual’ and for many, volatility can create problems.

Are student loans too big?

Australian voters tend to reject US style education favouring more egalitarian systems where income does not determine access. For Australian domestic students, the cost of completing a bachelor degree is generally between $20,000 and $45,000, excluding some of the higher value courses

Finalist Award Recognition

We are thrilled to announce that Ricky Goel and Rodney Wark have been recognised as finalists in their recent industry awards submission for 2024!

Growth and Dedication at Forsyths

At Forsyths, growth and dedication are at the heart of everything we do. We pay tribute to the incredible career of Megan Edwards, who has retired after 31 years of dedicated service and are proud to announce Diane McLeod's promotion to Director of Leadership and Development.

Tax Consequences of Inheriting Property

Beyond the difficult task of dividing up your assets and determining who should get what, it’s essential to look at the tax consequences of how your assets will flow through to your beneficiaries.

More women using ‘downsizer’ contributions to boost super

If you are aged 55 years or older, the downsizer contribution rules enable you to contribute up to $300,000 from the proceeds of the sale of your home to your superannuation fund (eligibility criteria applies).

Payday super: the details

Payday super’ will overhaul the way in which superannuation guarantee is administered. We look at the first details and the

impending obligations on employers.

From 1 July 2026, employers will be obligated to pay superannuation guarantee (SG) on behalf of their employees on the same day as salary

and wages instead of the current quarterly payment sequence.

Beyond Profits: How Community Engagement Fuels Business Growth

In today’s fast-paced world, businesses are relentlessly focused on growth, reducing costs, and chasing targets. But amid this drive for success, one powerful objective is often overlooked in a business strategy and that’s community engagement.

$81.5m payroll tax win for Uber

Multinational ride-sharing system Uber has successfully contested six Revenue NSW payroll tax assessments totalling over $81.5 million. The assessments were issued on the basis that Uber drivers were employees and therefore payroll tax was payable.

Property and ‘lifestyle’ assets in the spotlight

Own an investment property or an expensive lifestyle asset like a boat or aircraft? The ATO are looking closely at these assets to see if what has been declared in tax returns matches up.

It wasn’t me: the tax fraud scam

You login to your myGov account to find that your activity statements for the last 12 months have been amended and GST credits of $100k issued. But it wasn’t you. And you certainly didn’t get a $100k refund in your bank account. What happens now?

The rise in business bankruptcy

ASIC’s annual insolvency data shows corporate business failure is up 39% compared to last financial year. The industries with the highest representation were construction, accommodation and food services at the top of the list.

Divorce, you, and your business

Breaking up is hard to do. Beyond the emotional and financial turmoil divorce creates, there are a number of issues that need to be resolved.

When is a gift not a gift?

The Tax Commissioner has successfully argued that more than $1.6m deposited in a couple’s bank account was assessable income, not a gift or a loan from friends.