News

Growth and Dedication at Forsyths

At Forsyths, growth and dedication are at the heart of everything we do. We pay tribute to the incredible career of Megan Edwards, who has retired after 31 years of dedicated service and are proud to announce Diane McLeod's promotion to Director of Leadership and Development.

Tax Consequences of Inheriting Property

Beyond the difficult task of dividing up your assets and determining who should get what, it’s essential to look at the tax consequences of how your assets will flow through to your beneficiaries.

More women using ‘downsizer’ contributions to boost super

If you are aged 55 years or older, the downsizer contribution rules enable you to contribute up to $300,000 from the proceeds of the sale of your home to your superannuation fund (eligibility criteria applies).

Payday super: the details

Payday super’ will overhaul the way in which superannuation guarantee is administered. We look at the first details and the

impending obligations on employers.

From 1 July 2026, employers will be obligated to pay superannuation guarantee (SG) on behalf of their employees on the same day as salary

and wages instead of the current quarterly payment sequence.

Beyond Profits: How Community Engagement Fuels Business Growth

In today’s fast-paced world, businesses are relentlessly focused on growth, reducing costs, and chasing targets. But amid this drive for success, one powerful objective is often overlooked in a business strategy and that’s community engagement.

$81.5m payroll tax win for Uber

Multinational ride-sharing system Uber has successfully contested six Revenue NSW payroll tax assessments totalling over $81.5 million. The assessments were issued on the basis that Uber drivers were employees and therefore payroll tax was payable.

Is the RBA to blame? The economic state of play

The politicians have weighed in on the Reserve Bank of Australia’s economic policy and their reticence to reduce interest rates in the face of community pressure. We look at what the numbers are really showing.

Property and ‘lifestyle’ assets in the spotlight

Own an investment property or an expensive lifestyle asset like a boat or aircraft? The ATO are looking closely at these assets to see if what has been declared in tax returns matches up.

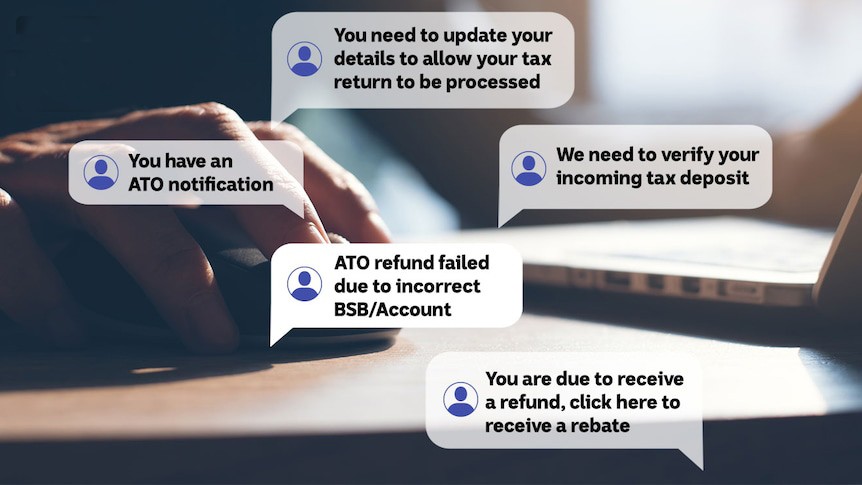

It wasn’t me: the tax fraud scam

You login to your myGov account to find that your activity statements for the last 12 months have been amended and GST credits of $100k issued. But it wasn’t you. And you certainly didn’t get a $100k refund in your bank account. What happens now?

The rise in business bankruptcy

ASIC’s annual insolvency data shows corporate business failure is up 39% compared to last financial year. The industries with the highest representation were construction, accommodation and food services at the top of the list.

Divorce, you, and your business

Breaking up is hard to do. Beyond the emotional and financial turmoil divorce creates, there are a number of issues that need to be resolved.