Used goods for private use? Here's the latest values.

This common practice can occur in businesses such as butchers, bakers, corner stores, cafe's and more.

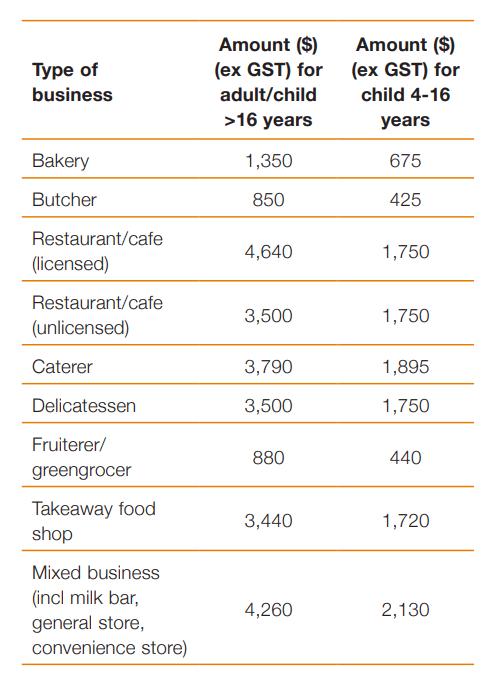

It regularly issues guidance for business owners on the value it expects will be allocated to goods used from trading stock for private use. The table below shows these values for the 2019-20 income year.

The basis for determining values is the latest Household Expenditure Survey results issued by the Australian Bureau of Statistics, adjusted for CPI movements for each category.

Note that the ATO recognises that greater or lesser values may be appropriate in particular cases, and where you are able to provide evidence of a lower value, this should be used.