ATO extends COVID-19 relief measures for SMSFs

SMSF trustees that are financially impacted due to COVID-19 because of extended lockdowns in certain States and Territories will be granted

extended relief to cover the 2021-22 financial year.

The relief was originally offered by the ATO to SMSFs for the 2019-20 and 2020-21 financial years where certain situations may have caused

SMSF trustees to contravene the superannuation laws.

For example, a SMSF trustee may have provided or accepted certain types of relief, such as giving a tenant/s (including a related party

tenant) a reduction in rent if they were financially impacted due to COVID-19. As charging a price that is less than market value will

usually give rise to contraventions under the superannuation laws, the relief measures will avoid this outcome if the arrangement meets

certain criteria (ie, the relief is offered on commercial terms and the arrangement is documented, etc).

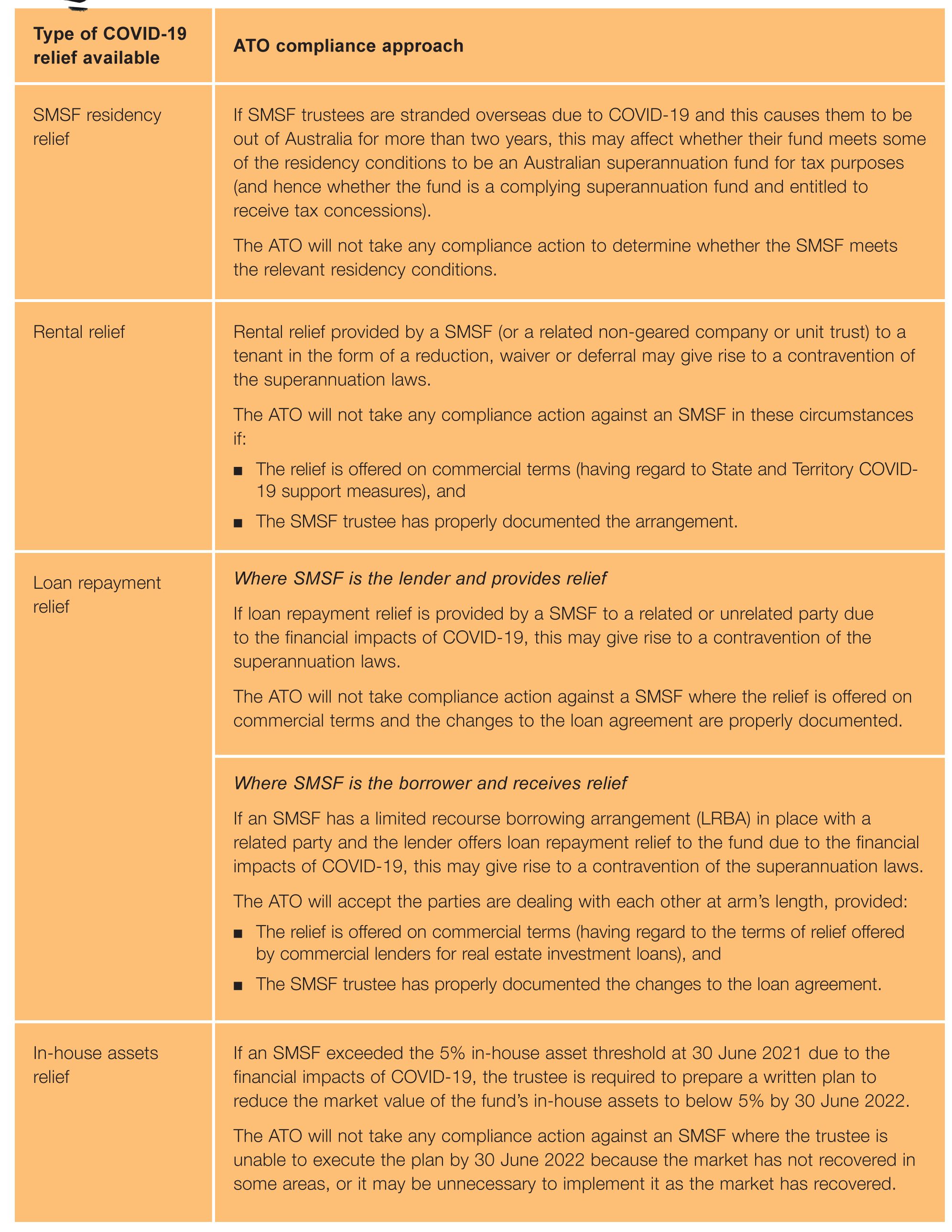

The relief measures available

In September, the ATO announced it would extend the several types of relief to SMSF trustees for 2021-22: see table overleaf.

Actions required for SMSF trustees

SMSF trustees must ensure they properly document the relief and can provide their approved SMSF auditor with evidence to support it for the

purposes of the annual SMSF audit.

When documenting any changes, providing the reasons for change will help the SMSF auditor when they use their judgement to determine

whether relief is offered on commercial terms due to the financial effects of COVID-19.

It is also good practice to document any changes by way of a minute or a renewed lease agreement or other documentation.

"We understand that COVID-19 continues to have a significant financial effect on self-managed super funds (SMSFs), particularly in some States or Territories where there are reoccuring and prolonged lockdown periods. As a result, you may still find yourself in a position where you (in your role as trustee), or a related party of the fund, are having to provide or accept certain types of relief, which may give rise to contraventions under the super laws. The COVID-19 health crisis has also resulted in many countries imposing travel bans and restrictions, and you may have become stranded overseas for long periods, which can have an effect on your fund’s residency status. In recognition of this, we have extended the following types of relief, currently offered for the 2019-20 and 2020-21 financial years, to cover the 2021–22 financial year. You must ensure you properly document the relief and can provide your approved SMSF auditor with evidence to support it for the purposes of the annual SMSF audit."

Australian Taxation Office